Last month, Global Times, a Chinese nationalist tabloid, ran a headline “China gears up to use rare Earth advantage”. This sentiment was echoed throughout other Chinese media outlets, along with outlets in the United States.

Over the past few months, as trade tensions between the United States and China remain volatile, many have speculated that it is only a matter of time that China, by threatening to withhold shipments, use its control of the rare Earth metals industry as leverage in negotiations over trade with the United States citing the potential benefits and China’s long history of taking advantage of its rare earth metal industry. Rare earth metals, classified by elements 57 – 71, remain a crucial ingredient in the production of industrial and military technologies and with China responsible for 70% of the world’s supply ., China can meaningfully impact US enterprises by taking advantage of its monopoly in the industry. Withholding shipments would give Beijing much-needed leverage in trade negotiations, along with seriously crippling a range of US businesses and jeopardizing United States national security by handicapping the military, which all remain reliant on the commodities to function at full capacity. Furthermore, in the past, Beijing has been unafraid to use its control of the industry for political gain. Most notably, in 2010, during a dispute with Japan, China withheld rare Earth metal shipments to Japan, severely raising the price of the commodities and forcing Japan to give in during negotiations.

This speculation has come to control the mainstream opinion regarding China’s rare earth metal industry with many believing that it is inevitable that Beijing uses its rare Earth metal industry for political gain. However, despite the potential benefits and its historical willingness to do so, this may not be the case and in hindsight, China may choose not to leverage its rare Earth metal industry given the potential consequences and exaggerated benefits of doing so.

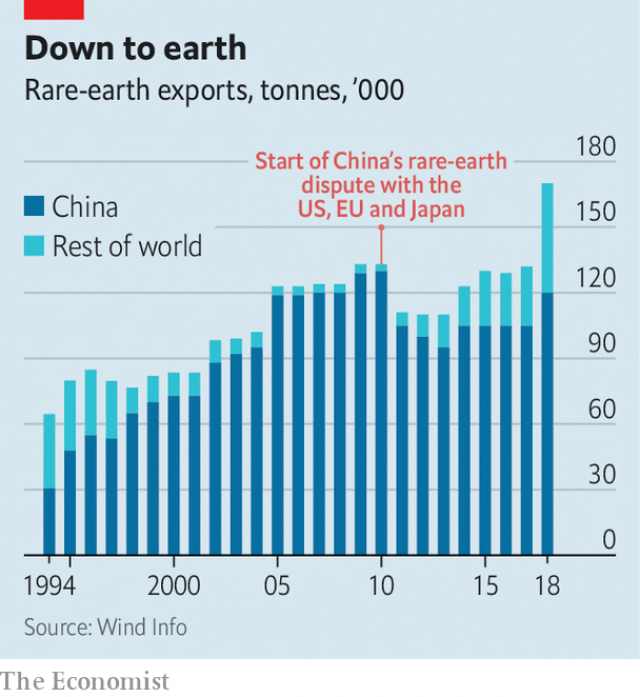

Long term, preventing the United States from receiving Chinese rare Earth metals would hurt China’s economy, paving the way for Beijing to lose a monopoly it has held since the 1980s. If China decides to use its rare Earth metal industry as a bargaining chip, it will trigger a sequence of events that will only hurt China in the future. In the immediate aftermath of losing China’s supply of rare-earth metals, the United States government, along with firms will start searching for non-Chinese producers of the commodities, investing in facilities and countries that will produce the commodities, which in the long run will cut into China’s market of the good. The United States has already started this process with the Mountain Pass Mine in California, once the leading supplier of the commodities, which shut down in 2002, reopening and the United States, more recently, announcing it would help other countries develop their respective rare Earth metal industries. Moreover, China’s grasp of the industry has already been dwindling, with Beijing losing considerable market share over the past 10 years. In 2010, China was responsible for 95% of the world’s supply of commodities. Today, it is responsible for 70%. Withholding rare Earth metals from the United States would accelerate not only the United States’ urgency but also that of the rest of the world to find non-Chinese rare Earth metal producers. In the long run, this could severely damage China’s rare earth metal industry economically and politically at a time when China’s economy is slowing and President Xi Jinping is losing support.

Furthermore, in the long run, withholding rare Earth metals would limit the potential of Beijing’s rare Earth metal industry. China remains the most efficient rare Earth metal producer in the world with recent competition only being as a result of China’s unpredictability regarding its willingness to leverage its industry. If China can credibly reassure other countries that it will not use its rare Earth monopoly for political gain and other countries gain confidence in this reassurance, China could see some of its market share revert. A trusted Chinese rare Earth metal industry would provide the lowest prices in the market and come to dominate an industry that will exist far into the future.

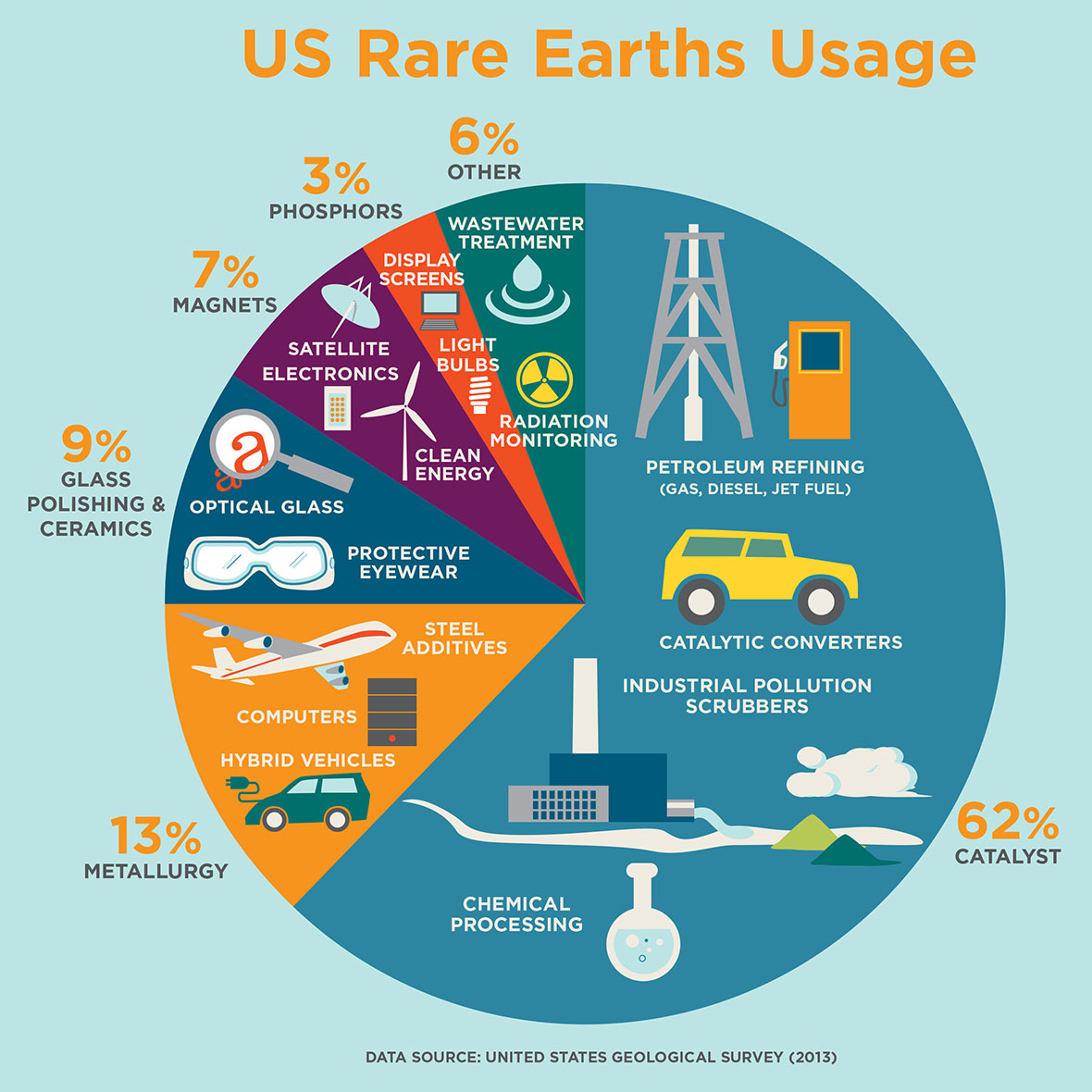

In the short run, withholding rare Earth metal shipments to the United States will no doubt hurt the United States, however, the impact may not be as severe as many predict, especially when it comes to the military’s reliance on rare Earth metals.

While the military remains reliant on rare Earth metals to maintain its technological advantage, it accounts for just 1% of the United States’ demand of the good. As a result, in the event of China preventing the United States from acquiring its rare Earth metals, the United States military would likely not be affected.

Although the United States military would be able to survive without Chinese rare Earth metals, mainstream opinion is correct in speculating that United States industry would be hit tremendously. The United States relies on China for over 75% of its rare earth metal industry and without access to Chinese rare Earth metals, prices of the commodities would rise strongly with firms not necessarily being able to pass the increased cost downstream. While these implications provide a great incentive for China to leverage its rare Earth metal industry, these implications would only hold in the very short run, while in the long-run US businesses will slowly shift to non-Chinese producers as well as potential alternative inputs

In the immediate future, in addition to hurting American businesses, withholding shipments of rare Earth metals to the United States would also hurt Chinese enterprises. As a direct result of withholding shipments, Chinese rare Earth metal producers would be hurt, losing a considerable market share. Additionally, as The Economist notes cutting off the United States “would also hurt Chinese companies, which are often the ones that build the motors and batteries for American customers using rare-earth magnets.”

Mainstream opinion remains correct in assuming that withholding rare Earth metals to the United States would hurt the United States economy, most likely forcing the United States into some concessions in the long run. But it fails to consider the potential consequences for China in these decisions, specifically the effects this decision will have on the Chinese economy. When weighing the costs and benefits of leveraging the rare Earth metals industry, it seems that withholding the commodities to the United States would be extremely short-sighted and contrary to Beijing’s touted long term plan. However, it is up to Beijing to make the decision on whether it is worth it or not.

Featured image via Nikkei Asian Review